Recently, ams OSRAM and Signify released their Q1 2025 financial results. ams OSRAM, through its cost optimization strategy, continued to improve its profit structure. Ams OSRAM also announced plans to sell related assets to further optimize its financial position.

As for Signify, although its LED lighting business continued to be sluggish in markets such as Europe, the growth in its consumer business and the faster-than-expected recovery in the Chinese market helped Signify's overall business remain stable.

ams OSRAM: Q1 savings of €135 million; plans to sell some assets to pay off debt.

ams OSRAM's Q1 2025 financial report shows that its revenue reached €820 million (approximately RMB 6.706 billion) during the reporting period, a year-on-year decrease of 3% and a quarter-on-quarter decrease of 7%, exceeding the midpoint of the guidance expectation; adjusted EBITDA was €135 million, a year-on-year increase of 9%; the adjusted EBITDA margin was 16.4%; and the adjusted net loss was €23 million, better than the loss of €35 million in the same period last year.

Despite rising global economic uncertainty, ams OSRAM has achieved better-than-expected results through its "Re-establish the Base" (RtB) strategy, realizing cost savings of approximately €135 million in Q1. ams OSRAM stated that its profit structure is continuously improving, and its strong global presence and customer base have helped the company effectively cope with the volatility brought about by the new round of tariff policies.

It's worth noting that ams OSRAM revealed in its Q1 2025 earnings call that, in order to further optimize the company's financial situation, it plans to sell some businesses to raise more than €500 million to repay debt. Currently, ams OSRAM is in discussions with potential buyers. It is understood that the business to be sold may be ams OSRAM's core business, possibly including Micro LED assets, non-core semiconductor and optical assets, and some sensor-related businesses.

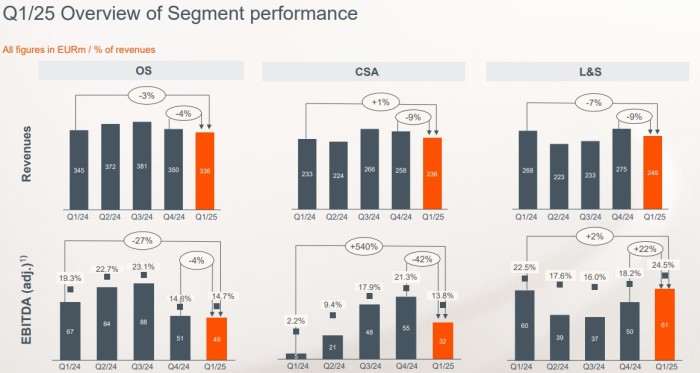

Looking back at the Q1 results, by business segment, ams OSRAM's semiconductor business segment generated €571 million in revenue, accounting for 70% of total revenue. Specifically, the Optoelectronics Semiconductor (OS) segment saw revenue of €336 million, a 4% decrease quarter-on-quarter, impacted by the seasonal decline in the automotive business. On the other hand, the Optoelectronics Semiconductor segment continued to receive one-off engineering fees (NREs) from customers for LED technology development during the reporting period.

The CMOS Sensors & ASICs (CSA) segment generated revenue of €236 million, a 9% decrease quarter-over-quarter, primarily due to the seasonal decline in consumer electronics sales. Its adjusted EBITDA margin was 13.8%, significantly higher than the same period last year, thanks to structural savings from the RtB program.

ams OSRAM expects orders in the automotive semiconductor sector to improve in Q2, but demand uncertainty remains; the industrial and medical sectors are expected to see a slight recovery; and demand in the consumer electronics sector will decline due to the traditional off-season.

In the Lamps & Systems (L&S) segment, ams OSRAM reported revenue of €249 million in Q1, a 9% decrease quarter-over-quarter and a 7% decrease year-over-year. This was primarily attributed to the structural contraction of the OEM halogen automotive lighting business and the end of the lifecycle for some products. Adjusted EBITDA margin reached 24.5%, higher than the previous quarter, benefiting from a strong product mix and other factors.

Looking ahead to Q2, ams OSRAM expects the automotive aftermarket to enter its off-season, leading to a decline in demand for related lighting products. Inventory adjustments for professional and specialty lighting fixtures (such as stage lighting and industrial lighting) are expected to continue, but some customers have already placed orders in advance to avoid the new tariffs.

Looking ahead to Q2 overall results, ams OSRAM expects group revenue to be between €725 million and €825 million; the adjusted EBITDA margin is expected to be 18.5% ± 1.5%, significantly higher than the 16.4% in the first quarter. This expectation reflects the continued progress of the company's strategic efficiency plan, "Re-establish the Base (RtB)".

In addition, the company expects a negative revenue impact of approximately €35 million due to the appreciation of the euro against the US dollar. Overall, the business performance in the second quarter will exhibit typical seasonal fluctuations, but business momentum is generally strengthening thanks to improved order volumes in the first quarter.

Signify: Q1 sales reached €1.448 billion

Signify achieved sales of €1.448 billion (approximately RMB11.955 billion) in Q1, a year-on-year decrease of 1.3%, and comparable sales (CSG) decreased by 2.8%. Signify stated that the decline in sales was mainly due to the contraction of traditional businesses. Although the growth in consumer business and the faster-than-expected recovery in the Chinese market were offset by weak OEM sales and continued weakness in European professional business.

The adjusted EBITDA margin reached 8.0%, slightly lower than 8.3% in the same period last year; thanks to structural cost control and the recovery of key markets, the company’s net profit reached €67 million, an increase of 52% from €44 million in the first quarter of 2024.

Signify reported that Q1 results met expectations, with most business segments showing sequential improvement, driven by strong contributions from smart connected products. The consumer business saw growth in all regions, boosting both revenue and profit. The professional lighting business maintained robust profit margins, with improvements in other markets offsetting ongoing challenges in Europe. In China, the company saw a faster-than-expected recovery in growth across both the professional and consumer sectors.

By business segment, sales in the professional segment reached €942 million, a 0.1% decrease year-on-year. Signify stated that strong growth in agricultural lighting offset some of the negative impact of overall weakness in Europe, while most other markets continued to show sequential improvement. Adjusted EBITDA margin decreased by 30 basis points to 7.1%.

Consumer business sales grew 4.2% to €311 million, including a 1.1% positive impact from currency exchange rates. All regions contributed to sales growth. Signify's smart home products continued to be driven by strong demand this quarter. Thanks to revenue growth, adjusted EBITDA margin improved by 40 basis points to 10.8%.

OEM sales reached €92 million, a 10.2% decrease year-on-year, partly due to the impact of business from major clients. Furthermore, the component business faced increasingly fierce price competition. Gross margins were affected by downward price pressures and insufficient absorption of fixed costs, resulting in an adjusted EBITDA margin of 4.2%.

Traditional business sales reached €92 million, a 22.8% decrease year-on-year, reflecting a structural downturn in the business. Adjusted EBITDA margin improved by 80 basis points to 18.4%, primarily due to an increase in gross margin. (Text: Irving)

![]() Gold+ Member Report

Gold+ Member Report

Global LED Industry Database and LED Manufacturer Quarterly Updates

4Q (Early December)

2Q (Early June)

3Q (Early September)

4Q (Early December)

If you want to know more about For details, please contact us:

Read next

Tianma successfully lit up a 7-inch Micro LED automotive standard product.

On July 9, Tianma Microelectronics announced the successful lighting of a 7-inch Micro LED automotive standard product....

NIO ET9 Officially Launched with MicroLED Headlights