On July 25, Signify announced its financial results for the second quarter and first half of fiscal year 2025.

In the second quarter, Signify achieved sales of €1.418 billion (approximately RMB11.202 billion), a year-on-year decrease of 4.4%; comparable sales decreased by 1.4%.

The company's adjusted EBITDA was €110 million, a decrease of 6.5% year-on-year; the adjusted EBITDA margin was 7.8%, slightly lower than 7.9% in the same period last year. Net income was €57 million, a decrease of 10.6% year-on-year, mainly due to a decline in operating profit and adjustments to projects. Signify's gross margin remained stable at 40.4%. Free cash flow was €36 million, a decrease of 29.4% year-on-year.

Looking back at the first half of 2025, Signify's overall sales were €2.866 billion (approximately RMB22.641 billion), a year-on-year decrease of 2.9%; comparable sales decreased by 2.1%. Gross margin remained stable at 40.6%. Adjusted EBITDA was €226 million, a year-on-year decrease of 5.7%, with an adjusted EBITDA margin of 7.9%, slightly lower than last year's 8.1%.

The company's net profit increased by 15.6% year-on-year to €124 million, mainly due to a decrease in financial expenses and adjustments. Free cash flow, however, decreased to €77 million (compared to €131 million in the same period last year).

Professional and Consumer Businesses Recover Growth <br /> Signify stated that its business continued its strong momentum in the second quarter, with both the professional and consumer businesses achieving comparable sales growth. Although overall comparable sales declined by 1.4%, excluding traditional lighting business, the company's actual sales increased by 0.8%.

In addition, Signify pointed out that smart connected and special lighting products now account for more than one-third of the company's total sales, which is an important achievement of the company's development strategy.

In terms of business segments, Signify has established a four-core business structure: Professional, Consumer, OEM, and Conventional, further emphasizing a customer-centric operating logic.

The professional business segment, after several quarters of weakness, achieved comparable sales growth of 0.2% in the second quarter, with quarterly sales of €931 million, a 2.9% decrease year-on-year. This improvement was mainly attributed to strong performance in the North American market and continued growth in connected lighting products globally. Nevertheless, the segment's adjusted EBITDA margin still declined to 7.4% from 8.1% in the same period last year.

In the first half of the year, professional business sales amounted to €1.872 billion, a decrease of 1.5% year-on-year; adjusted EBITDA was €136 million.

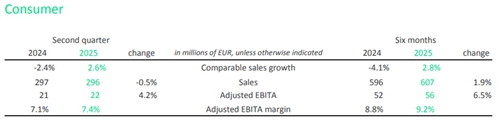

The consumer business segment continued its steady growth, achieving sales of €296 million in the second quarter, essentially flat compared to the same period last year; comparable sales increased by 2.6%, marking the third consecutive quarter of growth, primarily driven by the continued market popularity of Signify's smart home products such as Philips Hue. The adjusted profit margin for this segment improved to 7.4% from 7.1% in the same period last year.

With continued business growth, the consumer business achieved sales of €607 million in the first half of the year, up 1.9% year-on-year; adjusted EBITDA was €56 million, up 6.5% year-on-year.

In contrast, the OEM business was hampered by reduced orders from two major customers and intense price competition in the non-networked components market. Second-quarter sales fell 14.5% year-on-year to €90 million, with comparable sales down 11.6%. Adjusted EBITDA margin fell from 10.9% to 8.5%.

The OEM business reported sales of €182 million in the first half of the year, down 12.4% year-on-year; adjusted EBITDA was €12 million.

Traditional business segments experienced a structural decline. Second-quarter sales for this segment were €81 million, a 28.9% decrease year-on-year, with comparable sales down 26.8%. However, thanks to strict price and cost controls, its adjusted profit margin rose to 18.6%, the highest among all business segments.

Sales in the traditional business were €174 million in the first half of the year, down 25.8% year-on-year; adjusted EBITDA was €32 million.

While OEM and traditional businesses continue to face pressure, Signify's positive performance in the North American professional business and global consumer markets has provided strong support for the company's second-half results.

Therefore, Signify expects comparable sales to achieve single-digit growth for the full year of 2025 (excluding traditional business), with free cash flow reaching 7% to 8% of sales; the adjusted EBITDA margin is expected to be approximately 9.6% to 9.9%. (Compiled)