During the Q3 reporting period, the company achieved revenue of 853 million euros (approximately RMB 6.55 billion), a 10% increase quarter-on-quarter and a 3% decrease year-on-year. The revenue figures were in the upper-middle range of the company's expectations (790 million to 890 million euros).

Adjusted EBITDA was €166 million, with an adjusted EBITDA margin of 19.5%, up 70 basis points quarter-on-quarter and up 70 basis points year-on-year; adjusted net profit reached €27 million, up 50% quarter-on-quarter.

Based on the data from the first half of the year, ams OSRAM achieved a total revenue of €2.448 billion (approximately RMB18.8 billion) in the first three quarters (January-September) of 2025; the adjusted EBITDA for the first nine months totaled €447 million, corresponding to a profit margin of 18%; and the adjusted net profit reached €22 million, a significant increase compared to the same period last year (€1 million).

ams OSRAM CEO Aldo Kamper stated that the company's core semiconductor business achieved comparable growth as expected during the reporting period. Despite challenges from a weakening dollar and rising raw material prices, the company's revenue, profit, and cash flow all performed strongly in the second half of the year.

Financial data shows that, thanks to the progress of the "Re-establish the Base" strategic plan, ams OSRAM has achieved annualized cost savings of approximately €185 million as of Q3 2025. Notably, ams OSRAM's free cash flow (FCF) turned positive this quarter, reaching €43 million, a significant improvement from -€14 million in the previous quarter, reflecting increased operational efficiency.

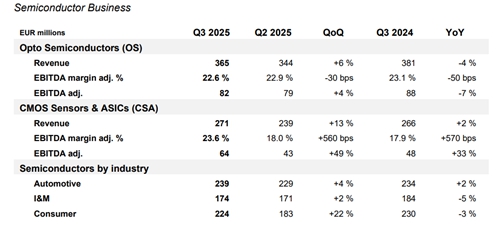

Looking back at the performance of ams OSRAM's various businesses in Q3, the semiconductor business segment contributed €637 million in revenue during the reporting period, accounting for approximately 75% of the Group's total revenue. Excluding non-core investment portfolio items and the impact of exchange rates, the core semiconductor business achieved comparable growth of approximately 9%.

The optoelectronic semiconductor (OS) business generated revenue of €365 million, a 6% increase quarter-over-quarter. This growth was primarily driven by a seasonal rebound in demand for plant lighting and a slight increase in sales in the automotive sector. Adjusted EBITDA was €82 million, representing a profit margin of 22.6%.

The CMOS Sensors & ASICs (CSA) business performed strongly, with revenue reaching €271 million, a significant increase of 13% quarter-over-quarter and 2% year-over-year. This was primarily driven by seasonal peak demand for consumer handheld device components and further stabilization in sales for industrial and medical applications. Adjusted EBITDA for this segment rose to €64 million, a 49% increase quarter-over-quarter and a 33% increase year-over-year.

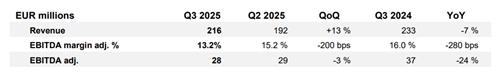

Lighting and Systems (L&S) generated revenue of €216 million, a 13% increase quarter-over-quarter, representing 25% of the company's total revenue. This quarter-over-quarter growth was primarily driven by the typical seasonal peak in the automotive aftermarket.

In terms of technological innovation and strategic cooperation, ams OSRAM signed a broad patent cross-licensing agreement with Nichia Chemical on October 16, covering thousands of patent innovations in the fields of LED and laser technologies, aiming to provide customers with stronger intellectual property protection. In addition, ams OSRAM launched an industry-leading 2D direct time-of-flight (dToF) sensor platform, applicable to fields such as smartphones and logistics robots.

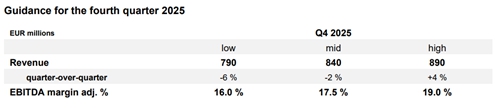

Looking ahead to Q4 2025, ams OSRAM expects Q4 revenue to be between €790 million and €890 million, with an adjusted EBITDA margin of 17.5% (±1.5%).

ams OSRAM anticipates its semiconductor business will follow a typical seasonal pattern, experiencing a slight decline in Q4, while its traditional automotive lighting business will continue to see strong demand in the aftermarket. Meanwhile, ams OSRAM confirmed its full-year 2025 free cash flow will exceed €100 million and projects total design-wins of €5 billion for 2025. (Compiled)

![]() Gold+ Member Report

Gold+ Member Report

Global LED Industry Database and LED Manufacturer Quarterly Updates

3Q (Early September)

4Q (Early December)

2Q (Early June)

3Q (Early September)

4Q (Early December)

2Q (Early June)

3Q (Early September)

4Q (Early December)

If you want to know more about For details, please contact us:

Read next

Involving Micro LED, automotive lighting, and other technologies, three projects are on fast-forward.

Recently, several projects in the LED field have been progressing simultaneously, including the commissioning of Thunde...

Samsung's AR glasses prototype is rumored to be unveiled in January next year.