The 26th CIOE China International Optoelectronic Exposition (CIOE) concluded last week. From the AR-related exhibition area of this exhibition, the following five major trends in the development of the AR glasses industry were observed.

Trend 1:

Amidst the fierce competition among numerous AR glasses, the near-eye display industry continues to heat up . In recent years, consumer-grade AR glasses products have emerged in large numbers, with technology companies participating in this still-developing sector, resulting in a "battle of a hundred glasses." The market is gradually responding to the active promotion of AR glasses by companies.

In a special report on smart glasses released by CCTV's Finance Channel in the first half of 2025, the head of procurement and sales for glasses at JD.com revealed that, with government subsidies and optimized supply chain costs, the transaction volume of smart glasses on the JD.com platform increased more than tenfold year-on-year in the first half of the year, and the search volume for related keywords also increased significantly, with an increase of more than 30 times, indicating a rise in demand. As a key category of smart glasses, AR glasses are also experiencing simultaneous growth in demand.

According to the "2025 Near-Eye Display Market Trends and Technology Analysis" report (read the report>), global AR glasses shipments are expected to reach 600,000 units this year, an increase of 9.1% year-on-year.

Simple numbers may not be enough to grasp the development of the AR glasses market, but the situation at the Optical Expo may be able to verify the authenticity of the market's popularity to some extent.

In terms of exhibitors, it is estimated that there will be more than 40 AR glasses-related companies exhibiting this year, which is an increase compared to previous years. These include upstream equipment and material suppliers, midstream near-eye display technology and optical components, and downstream system integration solution providers and brand manufacturers. The AR glasses industry chain is continuing to develop vigorously.

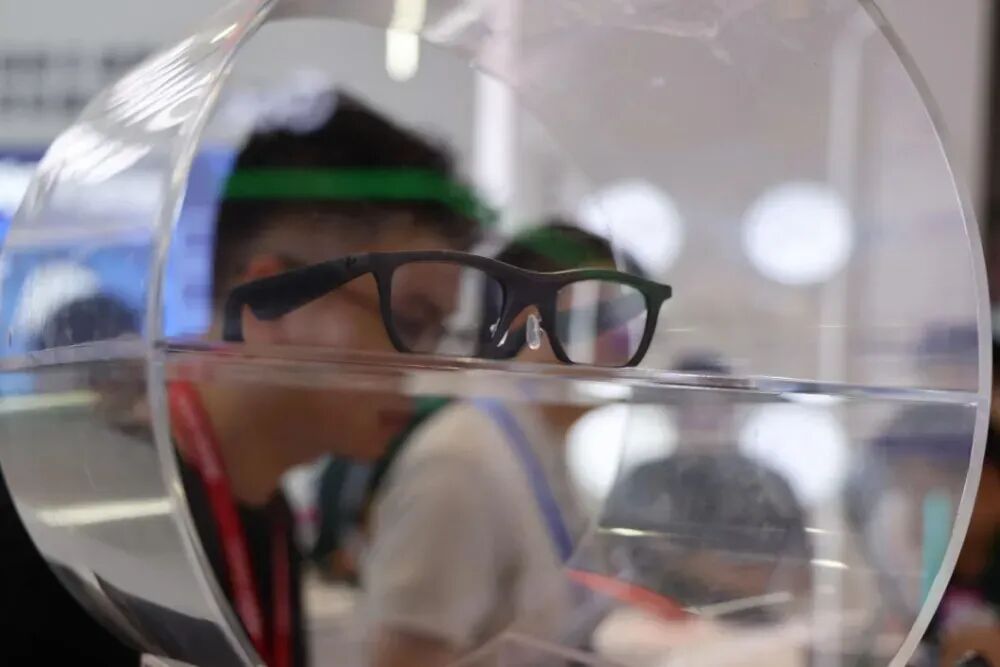

The AR glasses exhibition area was more popular than ever before, with crowds thronging around the booths of many companies, and visitors queuing up to experience the latest products. The area was extremely popular.

For example, in the exhibition areas of well-known companies such as JBD, Hongshi Intelligent, Novis Technology, Raysolve, Vision Technology, Xitai Technology, Yunguang Technology, and Goertek, there were large numbers of visitors waiting to experience the AR glasses products jointly developed by the companies and terminal brands.

JBD

Goertek

In addition, the booths of many optical component companies, such as Gudong Intelligent and Guangna Siwei, were also crowded with people experiencing the products and seeing how the latest micro-display and optical technologies have upgraded AR near-eye displays.

Gudong Intelligent

Embracing the Four Dimensions

It's worth noting that many visitors from overseas countries such as South Korea and Japan also attended the exhibition, which indirectly demonstrates that China has become a major hub for the global AR glasses industry, attracting people from various countries to exchange ideas. In the future, the domestic market may drive the global AR glasses industry to progress together.

As seen at the Optoelectronics Expo, the AR glasses industry chain, primarily focused on the domestic market, is continuously expanding. Consumer awareness and acceptance of AR glasses are gradually increasing, indicating a robust industry development and the potential for accelerated market growth. It is projected that with the maturation of near-eye display technology, AR glasses shipments will reach 32.1 million units by 2030.

Trend 2:

The integration of AI and AR glasses is deepening . The continued rise in popularity of AR glasses in recent years is due not only to the continuous maturation of industry technology, but also to the emergence of AI large-scale modeling technology. The industry believes that AR glasses are the most suitable platform for AI technology, indicating that AI technology allows consumers to have a clearer vision of AR glasses applications.

Currently, there are three main paths for AR glasses to apply large-scale AI models: first, independent research and development, pursuing technological closed-loop and independent control; second, integration with third parties, integrating external capabilities through APIs or SDKs; and third, a combination of self-development and integration, balancing autonomy and efficiency. These different solutions reflect the different trade-offs made by glasses manufacturers between technological barriers and market efficiency.

Judging from the AR glasses products exhibited at the Optoelectronics Expo, AI big data models continue to be deeply integrated into AR glasses, enabling them to achieve multimodal interaction. This integrates technologies such as voice, touch, gestures, and environmental perception to create a natural and seamless interactive loop. This deep integration is expected to fundamentally change the product form and market positioning of AR glasses.

Specifically, the integration of AI technology has driven the form factor of AR glasses. AR glasses are forming an "integrated" model by integrating components such as speakers, cameras, biosensors, and AR screens, combining multiple functions such as glasses, speakers, cameras, e-books, and projectors, becoming a smart terminal that takes into account audiovisual, health, and interaction. At the same time, the products mostly weigh between 31 and 70 grams, trending towards lightweight design, and the wearing experience is closer to that of ordinary glasses.

Luxshare Precision's full-color AR glasses: can access cloud-based AI intelligent large models and edge-based quantized small models.

FirstMirror Technology T100 Headset: Compatible with Android ecosystem, equipped with AI visual recognition model

Trend 3:

Manufacturers' diversified approaches drive advancements in optical waveguide technology . With the deep integration of AI large-scale model technology, more diverse text and image content will be presented in AR glasses. This means that AR glasses need to balance display effects with a lighter and simpler design than ever before, posing a new challenge to AR optical technology.

Fortunately, in response to the long-standing challenge of AR glasses demanding lighter and clearer displays, AR optics has developed a rich and diverse range of development paths. Whether it is traditional birdbath or subdivided technologies such as geometric waveguides and diffractive waveguides, many manufacturers are actively conducting research and development and making strategic plans in order to find the best optical approach.

Taking waveguide manufacturers at the Optical Communication Expo as an example, it was observed that, in addition to continuously deepening their expertise in different technological paths, waveguide manufacturers are increasingly emphasizing consumer experience and shifting their focus to overall solutions. Compared to the past competition mainly focused on FoV (field of view) or luminous efficacy, manufacturers now emphasize full-color performance, imaging uniformity, and the elimination of rainbow effects—features closely related to user experience.

Analysts believe there are two possible reasons for this trend: first, the advantages of optical waveguides are difficult to fully realize due to current optical engine specifications; second, the polarization of information display and viewing needs has led manufacturers to converge their R&D directions, resulting in reduced product differentiation.

For example, companies such as Gudong Technology and Luxshare Precision showcased the most advanced PVG waveguide technology (polarized volume holographic waveguide), a new type of volume holographic grating technology developed on the basis of VHG (volume holographic grating technology). It not only inherits the advantages of VHG such as high efficiency and low cost, but also achieves significant improvements in field of view, optical coupling efficiency, and image uniformity through its unique anisotropic structure and polarization characteristics.

At the exhibition, Gudong Technology showcased its PVG waveguide technology, which is manufactured using holographic lithography. This technology improves light efficiency by 300% and transmittance by over 90%. Its unique grating design completely eliminates the rainbow effect. The technology is compatible with various wafer substrates such as resin and glass, and the cost of a single waveguide has been reduced to $10-30, a cost reduction of 80%.

PVG waveguide display effect (Image source: Gudong Intelligent)

On the other hand, manufacturers are also beginning to demonstrate the possibility of achieving high-quality imaging through different substrates and processes in order to cope with the unclear development path of optical technology.

In terms of substrates, silicon carbide, with its high refractive index and low loss characteristics, has become the mainstream material for optical waveguides, outperforming glass and plastics. Tech giant Meta even launched Orion, an AR glasses device using silicon carbide waveguides, sparking industry interest in the material.

For example, at this exhibition, Guangna Siwei showcased several products using silicon carbide etching technology, including silicon carbide full-color etched waveguides and silicon carbide etched fully laminated waveguides; Goertek launched its first silicon carbide etched full-color diffractive waveguide, which uses full lamination technology to eliminate air layers between lenses, is only 0.65mm thick and weighs 3.5g, and has uniform color and no rainbow effect within a 30° FOV viewing range.

Guangna 4D Optical Waveguide Products

In addition, facing a cost-driven market, manufacturers have introduced a variety of cost reduction solutions, such as a "one-to-two" system (one optical machine for two lenses) or hybrid processes to avoid expensive photomask setup costs. Overall, optical waveguide manufacturers have moved beyond the stage of working alone and are now strengthening cooperation with upstream and downstream partners, striving to bring consumers better choices and experiences.

LCoS+PVG optical waveguide one-to-two solution (Image source: Gudong Intelligent)

Trend 4:

LEDoS continues to move towards full-color, with the development of three-color combining and single-chip full-color dual-line technology.

LEDoS (Micro LED) is widely regarded as the most ideal AR micro-display technology due to its superior advantages in size, energy efficiency, brightness, and pixel density. As more diverse images and information need to be presented on AR glasses, the industry has been pushing for full-color displays using LEDoS technology.

While single-chip full-color may be the ultimate form of LEDoS, challenges such as full-colorization, chip miniaturization, and cost control have slowed the development of this technology. Therefore, three-color combining has become the preferred choice for more companies to quickly achieve full-color technology effects.

At the exhibition, companies such as JBD, Hongshi Intelligent, and Novis Technology are realizing higher-performance X-Cube architecture LEDoS display optical engines with smaller size and better display effect.

At the exhibition, JBD launched its latest "Hummingbird II" color light engine, which adopts JBD's new 0.1-inch LEDoS microdisplay and X-Cube architecture, achieving a volume of 0.2 cubic centimeters and an ultra-light weight of 0.5 grams, both of which are 50% smaller than the previous generation, with better display effect and lower power consumption.

Hummingbird II live performance

Hongshi Intelligent also brought its latest full-color LEDoS optical engine, Aurora Shadow XC6. The product's optical engine is only 0.35cc, with a combined brightness of over 2.5 million nits. While achieving high brightness, its efficiency reaches 8lm/w, and it has a longer battery life.

However, this does not mean that the development of single-chip full-color solutions has stopped. For example, at the exhibition, Hongshi Intelligent also brought the AC3 single-chip full-color chip with a hybrid stacked structure, and the sample brightness reached 2 million nits.

Hongshi Intelligent's AC3 single-chip full-color product (Image source: Hongshi Intelligent)

Raex showcased its PowerMatch1 monolithic full-color LEDoS display solution based on quantum dot lithography (QDPR) technology.

PowerMatch1 (Image source: Raysolve)

Off-site, there were also previous reports that JBD's single-chip full-color LEDoS display will begin mass production in the third quarter of this year.

Phoenix series (Image source: JBD)

Trend 5:

LCoS display technology has garnered increased attention . Recently, Meta officially released the Meta Ray-Ban Display Glasses. However, this product does not feature the more popular OLEDoS or LEDoS technologies, but instead opts for LCoS (Liquid Crystal on Silicon) technology combined with an array of waveguides to achieve full-color display primarily for information display purposes.

Perhaps due to the brand influence of Meta Technology, a major technology company, many LCoS technologies and related product solutions were also exhibited at this exhibition.

For example, Chipvision showcased an LCoS display chip, a 0.13-inch LCoS lightweight AR glasses, and a 0.26-inch LCoS micro-projection solution; Sunny Optical showcased 0.13-inch and 0.23-inch LCoS light engines; ams OSRAM showcased a QIDI Vida smart sports glasses that uses an LCoS (LED light source) light engine and binocular full-color diffractive waveguide; Luxshare Precision exhibited a 0.33cc FLCoS optical engine, etc.

In addition, it is worth noting that many optical manufacturers choose LCoS as the optical engine to match when demonstrating optical waveguide technology, or they do so to demonstrate the compatibility between their technology and LCoS.

QIDI Vida Smart Sports Glasses

Analysts believe that while LCoS technology will gain prominence in the market in the short term with the adoption of Meta technology, OLEDoS will remain the mainstream in China due to its cost advantage. Furthermore, the growth of AR glasses using single-green LEDoS for notification purposes will also drive up the technological penetration rate of LEDoS in the future. Given the advancements in various microdisplay technologies, the long-term development trend of LCoS display technology remains to be seen.

Summary <br /> Based on the situation at the 2025 Optoelectronics Expo, both the overall AR glasses market and the AR near-eye display supply chain, represented by optical components and micro-displays, showed a positive development trend.

With the active investment of more AR glasses-related companies and capital in the future, AR glasses will continue to move towards higher definition, higher efficiency, lighter weight, lower cost, and closer to user needs, becoming a true next-generation smart terminal device.

What are the future development trends of the near-eye display technology industry? This conference will provide the answers.

On October 30th, its subsidiary, TrendForce Display, will host the 2025 Self-Emitting Display Industry Seminar in Shenzhen. At the seminar, companies such as HONGSHI Intelligent and analysts will conduct in-depth analysis of the latest trends in near-eye display technology and explore the future of the industry with industry peers.