Apple's Apple Vision Pro, launched in the first half of 2024, and Meta's Orion AR glasses prototype unveiled in the second half, have significantly enhanced public awareness of near-eye display technology and its applications, propelling the entire industry into a crucial development stage of metaverse near-eye displays. Major manufacturers are driving the trend of near-eye display devices towards becoming productivity tools through optimization of optical solutions and breakthroughs in micro-display technology.

Meanwhile, as part of a technology transformation strategy, capital investment and corporate alliances in the near-eye display field are in full swing. This combination of capital and technology not only accelerates product iteration but also promotes innovation and competition within the industry.

Furthermore, AI technology has brought new capabilities to near-eye display devices, and a new ecosystem is emerging as the industry continues to develop. The entire industry chain is actively exploring and expanding new business models and application scenarios, which provides strong impetus for the development of near-eye display devices and indicates a promising future for the near-eye display industry. At the 2024 TrendForce Self-Emitting Display Industry Seminar, TrendForce analyst Wan Wen presented a near-eye display market development and technology analysis, enabling many industry professionals to understand the current status and future trends of the near-eye display industry.

AR/VR/MR: Which near-eye display device will take center stage?

The development of the near-eye display industry can be traced back to stereoscopic vision proposed by physicist Charles in 1838. In 1963, Ivan Sutherland developed the first computer graphics-driven head-mounted display (HMD) and head position tracking system, marking a significant milestone in the history of VR technology.

After virtual reality was officially named in 1984, and with the advancement of computer technology, VR headsets and related applications gradually became widespread. Modern VR technology not only provides immersive visual and auditory experiences, but also simulates multiple senses such as touch and smell, making users feel as if they are in a virtual world. Modern VR technology is widely used in fields such as gaming, education, healthcare, and entertainment, and has ushered in a period of rapid development driven by the metaverse.

The history of AR devices is shorter than that of VR. AR devices only truly began to develop after Google released its first AR glasses, Google Glass, in 2012. Despite high market expectations and investment, the overall development of AR glasses fell short of expectations due to limitations in form factor, display quality, and ecosystem applications, resulting in a downturn for AR from 2016 to 2019. However, starting in 2019, manufacturers such as Rokid, Thunderbird, Xreal, and Magic Leap launched new products, and the hardware ecosystem continued to improve, ushering in an upward cycle for the AR industry.

VR achieves a fully immersive experience by introducing optical lenses, such as Fresnel lenses and pancake lenses, between the human eye and the microdisplay. These lenses utilize light refraction to magnify the displayed image while simultaneously projecting the virtual image into the human eye. AR, on the other hand, requires the viewer to see the real world. It uses optical components such as prisms, freeform surfaces, and waveguides to reflect, refract, or diffract the light emitted from the microdisplay, ultimately projecting it onto the human eye. This connects the virtual image with the real world, creating a mutually reinforcing effect.

The concept of MR emerged later than VR and AR. Currently, the industry's definition of MR can be roughly divided into two schools of thought: one school defines MR as AR+VR, while the other school emphasizes the ability of virtual and real interaction and the empowerment of cutting-edge technologies.

Near-eye display technology aims to seamlessly integrate the virtual and real worlds, enhancing interactivity, immersion, and remote collaboration. It holds significant application potential in healthcare, education, and industry. While some challenges and limitations currently exist in XR technology, its future prospects remain bright.

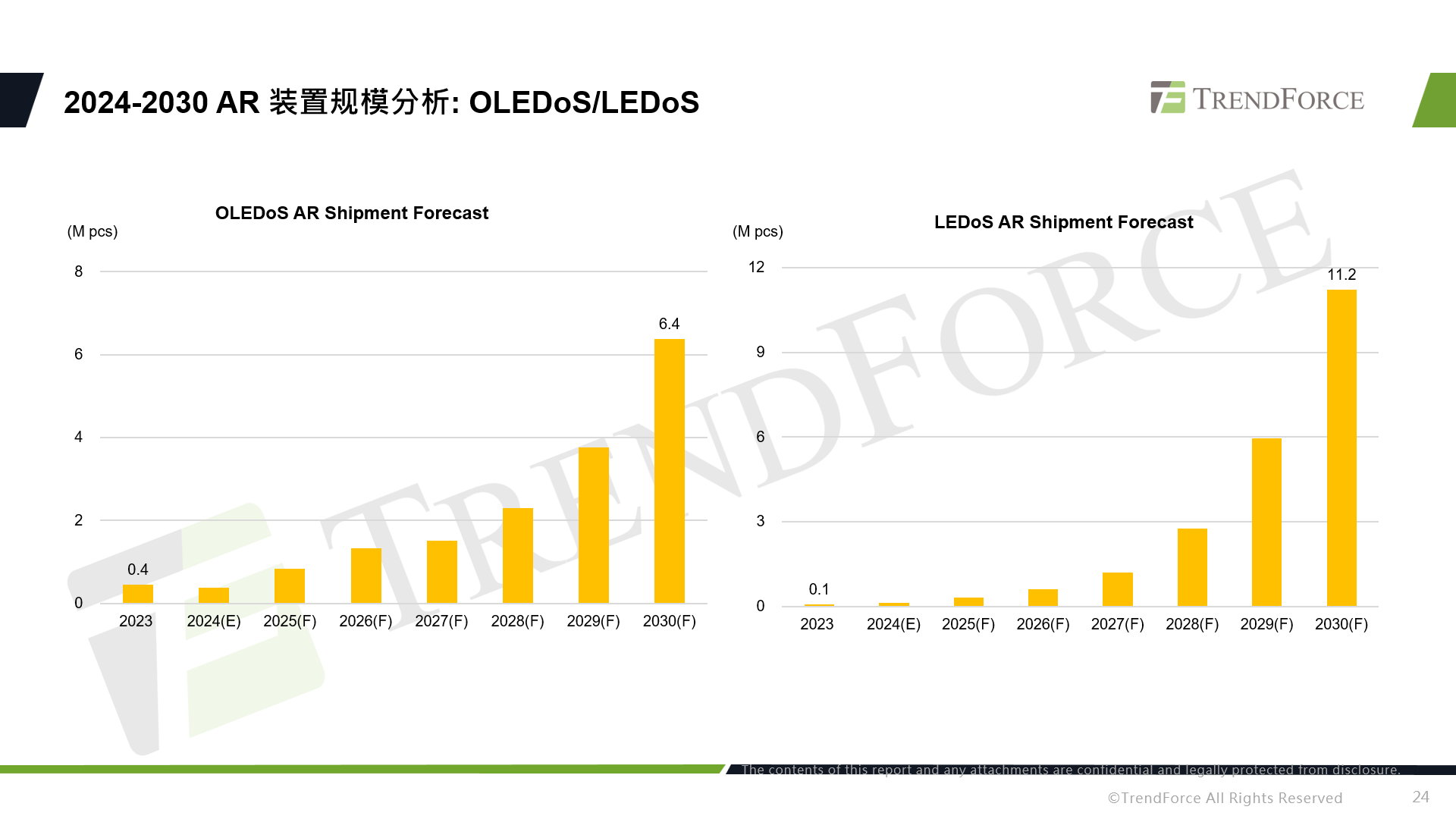

Whether it's the enrichment of VR/MR product application scenarios or the improvement of the AR product market ecosystem and capital investment, both will translate into driving forces for the expansion of the near-eye display device market. Therefore, TrendForce predicts that the overall shipment volume of near-eye display devices may reach 62.8 million units by 2030.

In the short term, the market and supply chain of VR/MR products are more mature than those of AR products. However, in the long term, the development of AI and technology will make AR products more versatile in terms of application scenarios, thus narrowing the market share gap between the two. TrendForce estimates that AR near-eye display devices will account for 41% of total shipments by 2030.

LCD/LCoS/LBS/LEDoS/OLEDoS: A Battle of Titans – What Are the Advantages and Disadvantages of Mainstream Near-Eye Display Technologies?

Near-eye displays essentially use a display device placed at a distance from the human eye that is not within direct visual range to render light field information to the eye, thereby reconstructing a virtual scene in front of the eyes. It is easy to see that near-eye display devices contain two important elements: microdisplay devices and optical devices.

In terms of optical components, VR devices, including Vision Pro, are moving towards thinner and smaller designs, which aligns with the evolution of optical display technology. From using lenses to thin the optical path to shortening it and creating the Pancake technology route, while it has brought about issues like ghosting and reduced light effects, Pancake technology, by lengthening the optical path with two additional reflective surfaces, can reduce thickness by 40% while maintaining a good field of view (FOV). It is an ideal solution for optimizing thickness and FOV design and has become a new optical technology trend for VR/MR products.

The optical architecture of AR is relatively more complex, and most products on the market currently use Birdbath and waveguide solutions. For AR glasses to achieve large-scale production in the consumer market, their weight cannot differ too much from that of ordinary glasses. Waveguides can be placed on the side of the glasses to project the display content into the user's eyes, offering high transparency while also being lightweight and thin, thus better meeting the user's wearing experience. Therefore, waveguides are considered the future of AR optical technology.

Microdisplays provide display content for near-eye display devices, and the images they generate serve as the source of images for the optical system. Microdisplays are also key components affecting the size, power consumption, brightness, contrast, and resolution of XR glasses. In the field of microdisplay technology, LCD, LCoS, LBS, LEDoS, and OLEDoS compete on the same stage, each with its own strengths and weaknesses.

The cost-effectiveness of LCD technology has allowed it to maintain a dominant market position. However, near-eye display devices are seeking higher resolutions, and LCD products, with their mere 1200 PPI, lack a competitive edge compared to other technologies. Nevertheless, improvements in liquid crystal materials can reduce dizziness, upgrades to backplane technology can boost resolution to 1500 PPI, and choosing appropriate backlights can significantly improve light utilization and suppress ghosting issues in VR/MR devices. These advancements indicate that LCD technology still has room for future optimization.

The advantages of LCoS technology include high resolution, high contrast, high fill rate, and good electron mobility. Due to the extremely small pixel size on LCOS panels, the LCOS optical engine can provide very high resolution, which is especially important when displaying high-definition images. At the same time, the reflective structure of LCOS technology enables high-contrast display effects, particularly excelling in dark scenes.

However, LCoS technology has high manufacturing requirements and a difficult-to-control yield rate, which increases production costs and complexity. Furthermore, the liquid crystal molecule conversion speed of LCoS technology is relatively slow; although it offers high resolution and vibrant colors, it is more prone to ghosting and blurring, resulting in a less than ideal overall viewing experience. Nevertheless, with technological advancements and cost reductions, LCoS technology is gradually improving these issues.

DLP technology can be paired with various waveguide solutions, is highly mature, and offers good display effects. Because DLP uses reflective projection technology, it has high light energy utilization, providing high brightness and high contrast images. However, DLP optical engines are relatively large. Due to size and cost considerations, DLP optical engines often use DMD chip designs, resulting in less vibrant colors and lower color reproduction compared to LCD optical engines. Furthermore, DLP-related products are currently exclusively supplied by TI, creating patent barriers and posing risks of supply chain bottlenecks and cost issues.

LBS uses MEMS galvanometers to precisely control the laser scanning path, consuming only the energy needed for the actual display pixels. Furthermore, LBS can image without an additional backlight, significantly reducing power consumption. However, since LBS uses a laser light source, it's difficult to avoid laser spot issues, and it may also cause problems such as edge distortion or low display resolution.

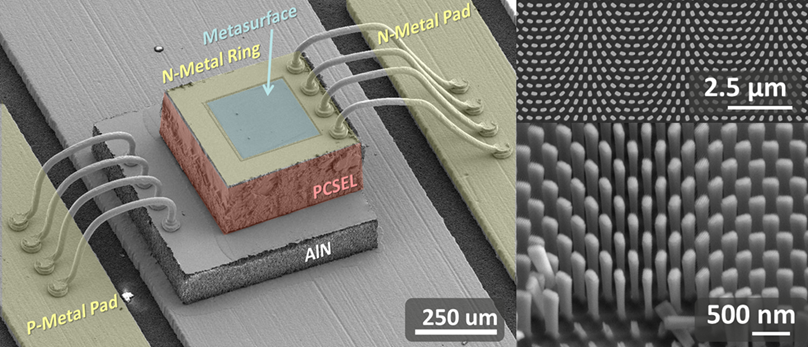

LEDoS technology uses LED light sources, which have high brightness and are resistant to ambient light interference, making them suitable for outdoor or brightly lit environments. Furthermore, by depositing LEDs onto a silicon substrate, LEDoS technology can significantly reduce the size of the optical engine, meeting the size requirements of AR devices. Secondly, LED light sources have low power consumption, making them suitable for AR devices used for extended periods. Therefore, LEDoS is considered the future technology for AR devices.

However, LEDoS technology still faces challenges in improving the luminous efficiency of miniaturized LEDs and achieving full color within the ultimate space utilization. In addition to the inherent EQE challenges, miniaturized LEDs also face challenges in luminous efficiency and optical crosstalk. Besides the need to design special materials to block/absorb light between pixels, LEDs also require the addition of side mirrors and microlenses, which increases the complexity of the manufacturing process and poses challenges to cost and yield control.

OLEDoS is fabricated using CMOS technology. Utilizing top-emitting OLEDs allows for higher luminous efficiency and raises the basic resolution of OLEDoS products to over 3000 PPI. Traditional OLEDoS uses a white OLED + C/F structure, where the C/F is typically fabricated on a separate glass layer. As the PPI increases, the wide-angle light emission can cause crosstalk, limiting the development of high-PPI OLEDoS. However, directly fabricating the low-temperature C/F on the OLED active layer encapsulation effectively reduces crosstalk and increases PPI. Sony calls this technology OCCF and has used it to achieve a 4032 PPI OLEDoS microdisplay product. LGD and BOE have also subsequently launched products with >4000 PPI.

From the perspective of VR products, LCD technology offers better cost-effectiveness and still holds a mainstream position. Meanwhile, OLEDoS technology, through its collaboration with Sony and Apple, has established its position in the high-end VR market. Coupled with the accelerating investment and deployment of domestic and foreign manufacturers in the OLEDoS field, more VR products equipped with OLEDoS technology will be launched in the future.

Apple Vision Pro, Image credit: Apple

Although LCD technology is facing short-term challenges from OLEDoS technology, VR products using LCD technology will remain highly competitive in the low-to-mid-range market in the long run. TrendForce forecasts that by 2030, shipments of VR/MR devices using LCD and OLEDoS technologies will reach 23.6 million units and 8.7 million units, respectively.

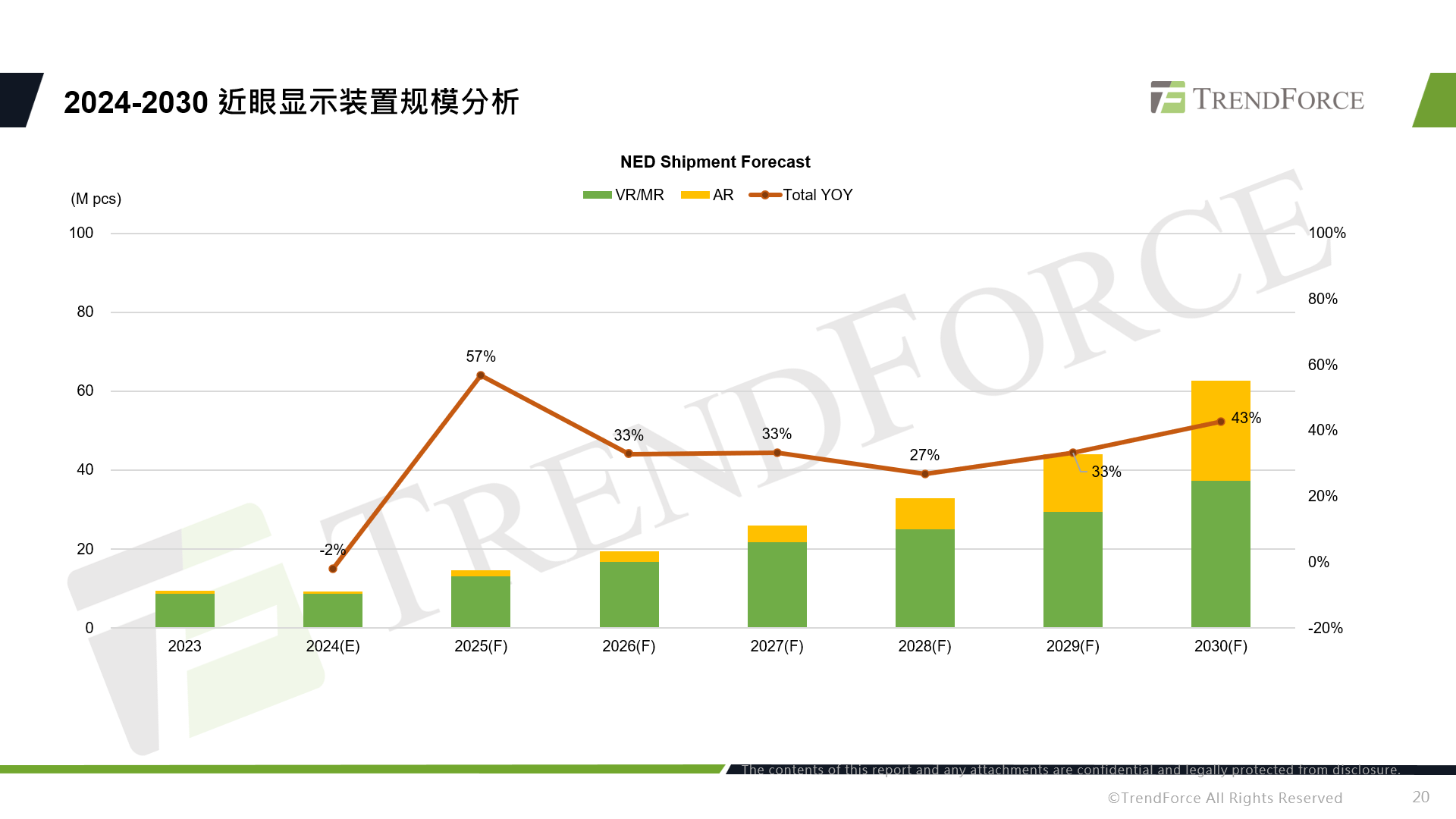

From the perspective of AR products, the mainstream AR technology currently on the market is still the combination of freeform surfaces or Birdbath with silicon-based OLEDs. OLEDoS technology has developed rapidly in terms of resolution, but it still has certain limitations in balancing brightness and color display. Considering the size and power consumption requirements of the optical engine of future AR devices, the combination of optical waveguides with LEDoS technology may become the future development trend.

Currently, full-color LEDoS technology is still in its early stages of development, with a low market penetration rate in the short term. However, its display advantages in AR applications have garnered support from brand manufacturers. Furthermore, collaborations between companies, such as Porotech and Foxconn, can expand the application scenarios for AR devices, which is also a major means of increasing market share. TrendForce estimates that by 2030, shipments of AR devices using OLEDoS and LEDoS technologies will reach 6.38 million and 11.22 million units, respectively.