In 2025, the display industry has come a long way through a process of both intense competition and expansion. From the development of Mini/Micro LED and COB/MIP/COG technologies, to the integration of AI and segmented application scenarios, and further to overseas expansion and channel penetration in the market, the industry's development outline has gradually become clear, and the fog surrounding the market has slowly dissipated.

Leading companies have all made their moves. At the overall strategic level, Leyard focuses on three core sectors: "display + cultural tourism + AI and spatial computing"; Unilumin Technology has elevated "LED + AI" to the group's top strategic priority; Absen places technological leadership at the core of its strategy and focuses on the cutting-edge development direction of the LED industry; AOTO Electronics focuses on its advantageous niche industries around the "AI + visual" strategy; Lehman Optoelectronics has incorporated green development into its core strategy and continues to increase investment in green technology research and development... Each company is defining its future with concrete actions.

However, the deeper development logic behind corporate strategies, the true dynamics of specific market segments, and the potential impact of industry giants crossing over into new sectors are the keys to predicting the future. Mr. Yu Bin, Research Director, recently shared insights at the 2025 Self-Emitting Display Industry Seminar, revealing the full picture of the market and future trends beneath these surface appearances.

The LED display market is generally slowing down, with significant regional differentiation.

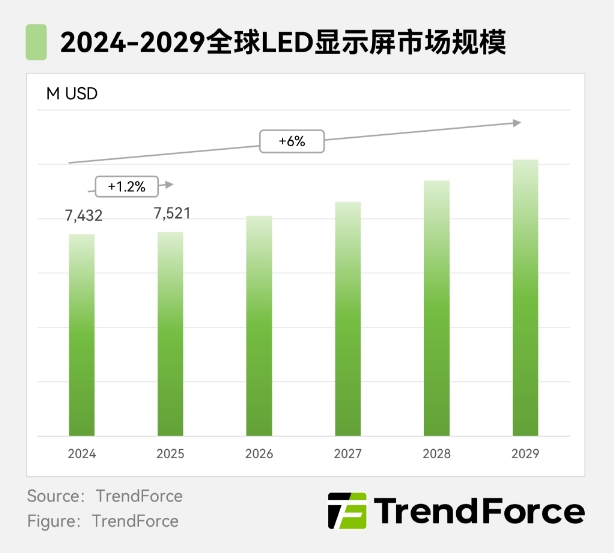

According to data, the global LED display market size is expected to reach US$7.52 billion this year, a slight increase of only 1.2% year-on-year, with small-pitch products remaining the main driver of market growth.

From a regional market perspective, domestic market demand and prices have been unsatisfactory this year, impacting high-end products. On one hand, the "vanity project" incident in Inner Mongolia in the first half of the year affected the procurement of high-end screens below P1.0; on the other hand, other macroeconomic measures such as the alcohol ban have also had a certain impact on the industry. In terms of technology, the competition between COB and MiP continues.

The European and American markets also face challenges. The retaliatory tariffs imposed by the United States have not only impacted display manufacturing but also suppressed end-user demand. For example, declining entertainment spending by Americans has directly led to reduced investment by Hollywood film companies, consequently weakening the performance of virtual filming products. Nevertheless, the European and American markets have not experienced negative growth this year, maintaining a generally slight growth level.

The highlight comes from the Asia-Africa-Latin America market. This market has maintained its growth momentum this year, a key reason for the industry's continued positive growth. This aligns with the consistent development pattern of the LED display industry: a new technology (such as fine-pitch LEDs) is always first adopted by the domestic government, then introduced to the civilian market after volume increases and price reductions, before penetrating developed economies in Europe and America; as costs further decrease, it finally enters markets in Asia, Africa, and Latin America. Currently, Asia, Africa, and Latin America are in the upward phase of this development cycle.

Technological Path Differentiation: P1.0 Faces Short-Term Pressure While COB Experiences Rapid Penetration <br /> As mentioned earlier, new technologies initially rely on government demand. Following the pandemic, domestic spending on related products has significantly decreased, making it difficult to promote products below P1.0. However, in the long term, products below P1.0 remain a core area of technological competition. With future cost reductions and the development of new application scenarios, this market is expected to experience rapid growth.

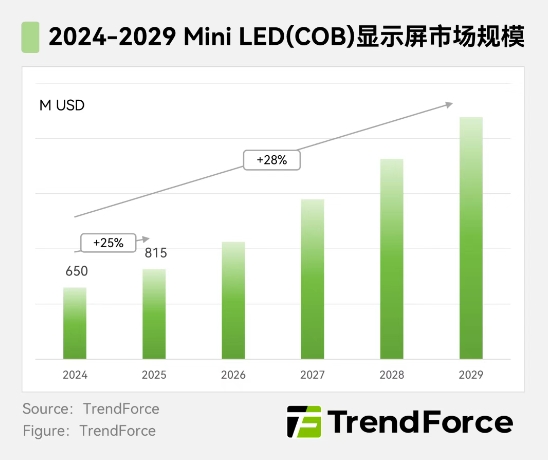

In contrast to the short-term pressure on P1.0, COB technology is entering a period of rapid penetration. The global COB output value is projected to reach US$815 million this year, a year-on-year increase of 25%.

While COB technology brings new demands, it primarily plays a replacement role within the industry. Taking P1.2 pitch as an example, COB is rapidly penetrating the market originally dominated by SMD, and this year it has begun to penetrate P1.5 and P1.8 pitches. It's worth noting that after encountering obstacles in promoting COB products below P1.0, manufacturers are now shifting their focus to promoting products with P1.2 to P1.8 pitches.

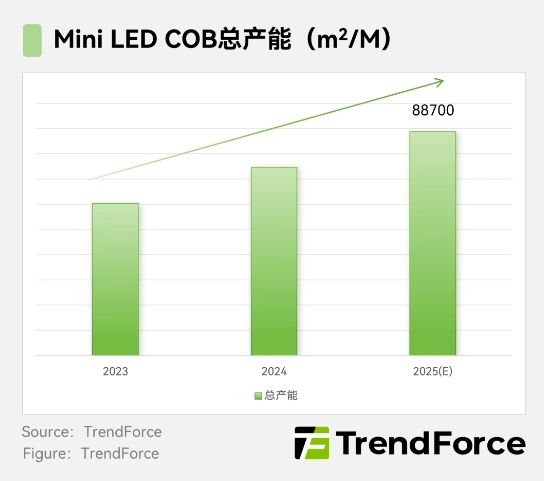

The rapid growth of COB (Chip-on-Board) technology is inseparable from industry investment. Statistics show that COB production capacity was approximately 60,000 square meters per month in 2024, and is projected to reach 88,700 square meters per month this year, representing a new capacity of approximately 20,000-30,000 square meters per month. A significant portion of this new capacity, exceeding 20,000 square meters per month, comes from investments by LCD panel manufacturers.

It's safe to say that the entry of traditional LCD panel manufacturers into this industry is a definite trend. Following BOE's entry, TCL CSOT, HKC, and Skyworth have also established production lines in the COB field this year. The entry of LCD manufacturers will change the competitive landscape of the industry.

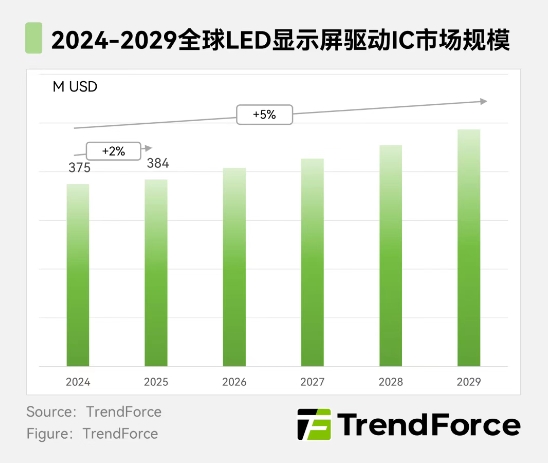

The market for LED display driver ICs is highly competitive, with numerous manufacturers. While the market is relatively concentrated, unlike control systems, new companies continue to enter the LED display driver IC market. The global LED display driver IC market is projected to grow by 2% this year, with the top five manufacturers holding over 80% of the market share.

Three Key Highlights in Segmented Application Markets <br /> With the macro market trending towards stagnation and technological paths continuing to diverge, growth ultimately needs to be driven by specific application scenarios. So, how is the market actually performing in key segmented markets such as all-in-one machines, cinemas, and rentals?

All-in-one PC Market

The growth rate of all-in-one PCs exceeded expectations last year, mainly due to strong performance in overseas markets. Early all-in-one PCs were primarily targeted at government agencies and large state-owned enterprises, resulting in high prices. Although costs have decreased in recent years, penetration in the consumer market remains low. However, in Europe and the United States, demand for all-in-one PCs in scenarios such as conferencing and educational training has seen significant growth.

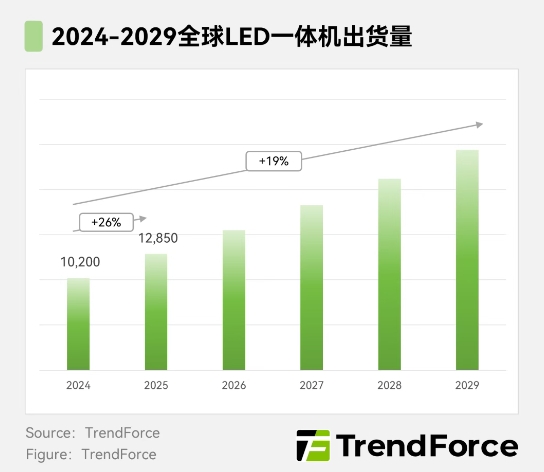

It is estimated that shipments of LED all-in-one machines will reach 12,850 units in 2025, representing a 26% increase, with overseas markets expected to account for over 60%. For all-in-one machine manufacturers, cultivating overseas channels is crucial.

According to the analysis, in terms of industry concentration, the top five manufacturers will account for nearly 90% of the market share in 2024. However, with more and more manufacturers entering the field, the industry concentration is expected to decline in the future.

In terms of product specifications, all-in-one PCs currently mainly consist of 130-140 inch models, accounting for over 50% of the market, with 2K resolution being the most common and a pixel pitch of approximately P1.5. In terms of technology, since P1.5 specifications are predominant, SMD LED technology remains the mainstream, although more and more manufacturers are launching all-in-one PCs using COB technology.

As for when they can enter the consumer (To C) market, it still faces difficulties. Although the price of all-in-one PCs continues to decline, they are currently mainly targeting the To B market. Shifting from B2B to B2C is not only a matter of price, but also involves after-sales service and product stability. Manufacturers' delivery capabilities in the B2C market are not yet mature, and hastily entering the market may damage their brand reputation.

cinema market

The cinema market is another application scenario that has seen rapid growth in the past two years.

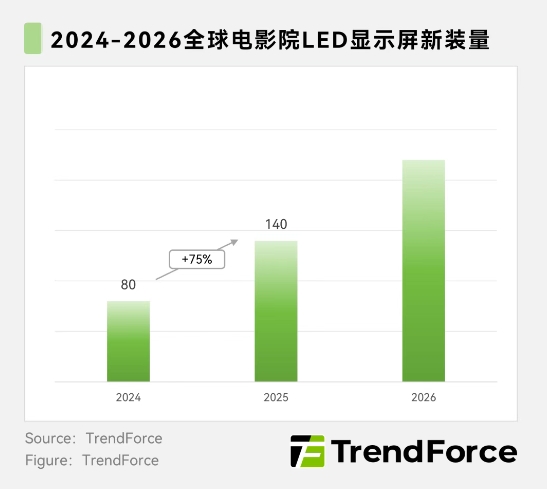

In terms of terminal installations, as of Q3 this year, over 80 new screens were installed, mainly in China. Globally, new installations are projected to reach 140 units this year, representing a 75% year-on-year increase.

Meanwhile, cinema screen specifications have also changed significantly, with a marked increase in the proportion of 16-meter and 20-meter screens. Especially in China, for cinemas planning to install large-screen displays, LED solutions offer a greater advantage in color performance compared to IMAX. The increase in LED display installations is due to the continued decline in product prices (currently, the installation cost of a 10-meter 2K screen has dropped to several hundred thousand yuan).

In terms of market value, the LED display market for cinemas is projected to grow to US$36 million by 2025, representing a 60% year-on-year increase. However, the overall size is still relatively small. Nevertheless, the market potential is enormous. There are approximately 200,000 cinemas worldwide, including about 20,000 to 30,000 high-end cinemas, while the current installation volume of LED displays is only in the hundreds.

More importantly, LED screens have brought new possibilities to cinemas. They enable cinemas to host offline events and live broadcasts (such as the Cosmic Experience Bar in Los Angeles), creating an immersive experience – a new hope that LEDs offer to the film industry.

rental market

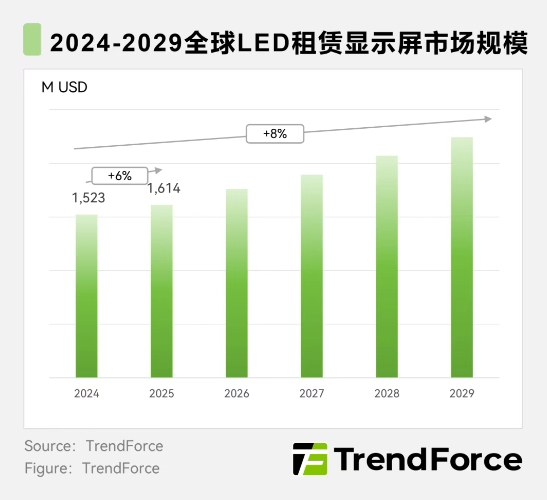

The growth logic for the rental market remains unchanged, with the number of screens used in events such as concerts continuing to increase. Although market performance has slowed down in recent years due to changes in the economic environment, and replacement cycles have lengthened, rental screens are also moving towards miniaturization of pixel pitch. The global LED rental display market is projected to reach US$1.614 billion by 2025.

The competitive landscape of the LED industry is evolving rapidly . Market demand and technological advancements are reshaping the industry's landscape. Faced with these opportunities and challenges, players across the value chain, from chipmakers and packaging companies to end-product brands, are accelerating their repositioning.

On the chip side: LCD manufacturers are actively entering this field, targeting not only Mini LED but also Micro LED. Since chips are a crucial element for the success of Micro LED, major LCD manufacturers are starting with the chip industry at its very source. Following MTC in 2017, HKC has also confirmed its entry this year, and a new competitive landscape is expected in the chip industry.

Packaging: Currently, the competition is mainly between MiP and COB technologies. For MiP to achieve significant development, it must shift to Micro LED chip packaging, and the key to cost reduction lies in chip size. Many manufacturers are already experimenting with manufacturing MiP using Micro LED chips. The competition between MiP and COB is not a zero-sum game; the two technologies will coexist and develop in the future.

LED Display Terminals: As mentioned at the beginning, the development logic of LED displays follows a penetration path from government to civilian use, and from domestic to overseas markets. Currently, the development speed of products below P1.0 is relatively slow, and companies' revenue still mainly relies on conventional small-pitch and outdoor products. Mature products above P1.0 have entered a stage of rapid penetration into the Asian, African and Latin American markets. Therefore, manufacturers are actively developing overseas channels, and even those that previously focused on the domestic market are turning to overseas markets. The current competitive landscape for terminal brand manufacturers is very clear: they must not only secure their current overseas market share but also prepare for the future market below P1.0 in terms of technology and applications.

Increased competition also presents an opportunity for industry upgrading . Finally, Mr. Yu Bin summarized the progress from both market and competition perspectives:

From a market perspective, in the long term, the three major growth trends of the LED display market remain unchanged: continued penetration into less developed economies, continued penetration into small and medium-sized customers, and continued advancement into emerging applications. The global LED display market is projected to grow to US$10.2 billion by 2029.

Regarding the competitive landscape of the industry, the large-scale entry of LCD manufacturers this year has become a key variable. Intense competition in the short term is inevitable and will have a profound impact on the industry structure. It is expected that the division of labor between panel manufacturers and end-user brands will become clearer in the future, forming a specialized model where brand manufacturers focus on channel development and manufacturers delve into process technology.

Meanwhile, the entry of LCD manufacturers has also brought tremendous development opportunities to the LED industry. These giants are expected to bring LED products into entirely new markets, pushing the industry, currently valued at over 50 billion yuan annually, to new heights. This is something the industry can look forward to. (Text: Mia)